Now Reading: Battle for WBD not over: Paramount goes directly to shareholders with $108.4B all-cash hostile bid

-

01

Battle for WBD not over: Paramount goes directly to shareholders with $108.4B all-cash hostile bid

Battle for WBD not over: Paramount goes directly to shareholders with $108.4B all-cash hostile bid

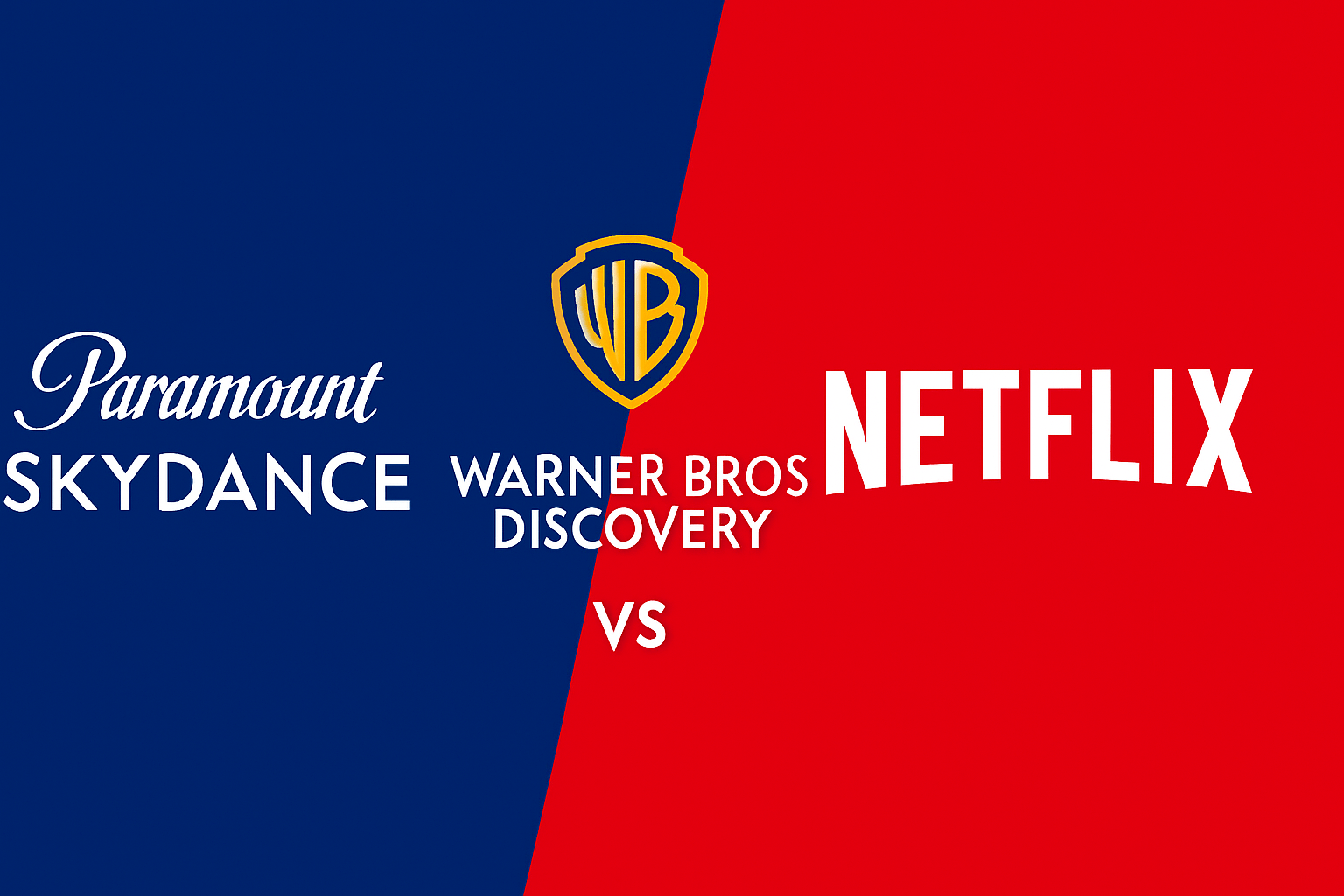

In a dramatic escalation of the battle for one of Hollywood’s most storied studios, Paramount Skydance on Monday unveiled a $108.4 billion all-cash hostile bid for Warner Bros Discovery (WBD), just days after Netflix struck a $72 billion agreement to acquire the company’s film studios and streaming operations.

In a statement on Monday, Paramount confirmed it had launched a tender offer to acquire all outstanding shares of WBD at $30 per share in cash, covering the entirety of the company, including its Global Networks division.

The move marks Paramount’s most forceful attempt yet to derail Netflix’s advance and reshape the future of the American entertainment industry.

Paramount framed its proposal as a decisive effort to keep WBD intact and create a consolidated media group capable of challenging Netflix’s dominance in global streaming.

The bid represents a premium over Netflix’s offer, which comprises a blend of equity and cash and includes only selected assets.

Paramount said its deal will be fully backstopped by the Ellison family and RedBird Capital, along with $54 billion of debt commitments from Bank of America, Citi and Apollo.

The company said it had submitted six proposals over a 12-week period but received little engagement from WBD leadership.

“Despite Paramount submitting six proposals… WBD never engaged meaningfully,” the company noted, adding that it had now taken its offer directly to shareholders to ensure they could evaluate what it described as a “clearly superior alternative.”

Paramount argues its offer is more certain and higher in value

In its statement, Paramount sharply criticised the Netflix agreement, calling it “inferior and uncertain” and warning that WBD shareholders would face a complex, multi-jurisdictional regulatory review with no guaranteed outcome.

It added that its own offer provides $18 billion more in cash than Netflix’s consideration and avoids dependence on future valuations of WBD’s linear networks, which have been weighed down by declining cable revenues and high leverage.

The company also disputed the WBD board’s assessment of the Global Networks business, saying its valuation assumptions were “illusory” and not grounded in operating performance.

“WBD shareholders deserve an opportunity to consider our superior all-cash offer for the entire company,” Paramount said.

David Ellison, chairman and chief executive of Paramount, argued the bid would lead to a stronger industry.

“We believe our offer will create a stronger Hollywood,” he said.

“It is in the best interests of the creative community, consumers and the movie theater industry… all stakeholders can begin to capitalize on the benefits of the combined company.”

Regulatory scrutiny shapes the bidding war

Netflix’s $72 billion offer has already triggered antitrust concerns in Washington, with critics warning that merging two of the world’s most powerful streaming platforms could reduce competition.

The Trump administration is said to be assessing the transaction with “heavy skepticism,” and President Donald Trump acknowledged on Sunday that the proposed deal could pose a “problem” in terms of market share.

Paramount, for its part, plans to argue that its bid would face fewer regulatory hurdles because of its comparatively smaller scale and longstanding ties with the administration, according to people familiar with the discussions cited by CNBC.

The company has maintained that keeping WBD whole, rather than splitting off its studio assets, is the best outcome for shareholders.

With Paramount now taking its case directly to shareholders, the next phase of the fight is likely to unfold swiftly—and publicly—as investors weigh competing visions for the future of one of Hollywood’s biggest players.

The post Battle for WBD not over: Paramount goes directly to shareholders with $108.4B all-cash hostile bid appeared first on Invezz